State of Personal Finance in the UK: Savings, Investment & Digital Banking

Survey Experts · 28.04.2023 · 34min read

Content

Personal finance is an essential part of our daily lives.

It involves managing our money, making financial decisions, and planning for the future.

Whether it's investing in stocks, retirement planning, paying off debt or maxing savings, financial literacy is crucial to achieving our financial goals.

As April is Financial Literacy Month, the latest Appinio Hype Train Report was set to explore the different financial products and services available to consumers and provide an overview of the current state of finance and digital banking in the UK.

This article will summarise the most significant results and we will take a closer look at the current state of savings accounts, investment options, debt management, and more.

We'll begin by discussing the importance of financial literacy and its current state in the UK. Next, we'll take a deep dive into:

- Different financial products available, including:

- Savings accounts

- Investment products

- Retirement planning products

- Insurance products

- Cryptocurrency.

- Digital banking in detail, including:

- Benefits

- Offers that could win new consumers.

- Savings in the UK and what Brits are currently saving for

💡Want to see the results at glance? Then download the Appinio Hype Train Report for free.

The Finance & Digital Banking Appinio Hype Train Report

Financial literacy in the UK

April is Financial Literacy Month, a time when individuals and organisations focus on promoting financial education and awareness.

Financial literacy is essential because it helps people make informed and effective decisions about managing their money.

With the increasing complexity of the financial landscape, individuals must have a solid understanding of basic financial concepts to make informed choices regarding investments, savings, credit, and debt management. Without financial literacy, individuals may not fully understand the implications of their financial decisions, leading to poor choices that can negatively impact their financial stability and future.

In recent years, financial literacy has gained significant attention, and the topic has been widely covered in the news.

This increased focus is due to several reasons, like the growing complexity of the financial world, the rise of digital currencies, and the COVID-19 pandemic's economic impact.

The Appinio Hype Train Report reveals that 52% of Brits don’t feel they have enough knowledge to consider themselves financially literate. This lack of confidence in understanding finance, financial products, and financial decisions by half of the Brits puts them at a disadvantage.

It's important to have, at least, a basic understanding of different financial products such as savings accounts, investments (including stocks, bonds, mutual funds, and ETFs), retirement planning options, or credit scores.

The latter ones are used by lenders to determine the creditworthiness of individuals. A good credit score can help secure better loan terms and lower interest rates.

It's also important to understand basic financial planning concepts such as budgeting, debt management, and insurance.

By improving financial literacy and understanding these concepts, individuals can make better financial decisions and improve their overall financial wellbeing.

Financial products: which ones do Brits hold?

There are a variety of financial products available in the UK that can help people achieve their financial goals.

Here are some of the most popular options in the UK:

- Savings accounts

More than one in two Brits (58%) hold a savings account.

These accounts offer a low-risk way to earn interest on the money saved. They're an ideal option for short-term savings goals, emergency funds, or saving up for a larger purchase. - Investment products

Investment products may be a good option when looking for higher potential returns. Some popular options include:- Stocks

One in four Britons (24%) have some stocks.

Buying a stock, means buying a small piece of ownership in a company. Stocks can offer high potential returns, but also come with higher risk.

The value of a stock can go up or down based on various factors such as the company's performance, industry trends, or economic conditions. Investors can profit from stocks by buying low and selling high, or through dividends paid out by the company to its shareholders. - Bonds

Bonds are debt securities issued by companies or governments as a means of borrowing money. When you purchase a bond, you are essentially loaning money to the issuer in exchange for periodic interest payments and the return of your principal investment when the bond matures. Bonds are generally considered less risky than stocks and can provide a steady stream of income for investors. - Managed funds

17% of UK respondents say they hold managed funds.

Also called mutual funds or collective investment schemes, are portfolios of diversified investments managed by a professional fund manager on behalf of individual investors. These funds allow investors to access a diversified mix of investments that may be difficult to achieve on their own, and investors purchase units or shares that reflect the underlying value of the assets held by the fund. - ETFs

Over one in ten (13%) Brits invest in ETFs.

ETFs, or exchange-traded funds, are investment funds that trade on stock exchanges like individual stocks. ETFs are typically designed to track the performance of a particular index, such as the S&P 500, and are made up of a basket of assets, such as stocks or bonds, that mimic the composition of the index. ETFs provide investors with an easy way to gain exposure to a wide range of assets at a lower cost than buying each asset individually. Additionally, ETFs can be bought and sold throughout the trading day, providing investors with more flexibility than traditional mutual funds. - Cryptocurrencies

One in four (24%) Brits say they have cryptocurrencies.

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank. Unlike traditional currencies, which are issued and controlled by a government, cryptocurrencies use decentralised technology, such as blockchain, to manage and record transactions. Cryptocurrencies have gained popularity among investors due to their potential for high returns and the relative anonymity they provide. However, they are also highly volatile and their value can fluctuate rapidly.

- Stocks

💡Want to deep dive into what UK consumers think of Cryptocurrencies, NFTs and other investment products?

We have a spotlight for that! Download the Investment Appinio Spotlight and satisfy your curiosity!

The Investment, Crypto & NFTs Spotlight

- Retirement planning products

It's important to save for retirement, and there are a few different products that can help you do so. Some options include:- Pensions

In the UK, pensions are typically provided through an employer-sponsored scheme known as a "workplace pension." These schemes are set up by the employer and provide employees with a way to save for their retirement.

There are two types of workplace pensions in the UK: defined benefit (DB) and defined contribution (DC) schemes.

Since 2012, all UK employers have been required to enrol eligible employees into a workplace pension scheme and contribute to it. The scheme is known as automatic enrolment, and it is designed to help people save for their retirement (especially in extreme cases, like the cost of living crisis).

Employees can choose to opt out of the scheme if they wish, but this means they will be giving up the employer contributions as well as the tax relief on their own contributions.

Our study found that over one in four (26%) Brits have a private pension.

- Pensions

-

- Annuities

These are insurance products that provide a guaranteed income during retirement.

- Annuities

- Insurance products

One in five (20%) Brits hold some kind of insurance product. Some common types of insurance include:- Health insurance

Covers medical expenses and treatments. - Car insurance

Covers damage to your vehicle and liability in the event of an accident. - Life insurance

Provides a payout to your beneficiaries in the event of your death. - Homeowners/renters insurance

Protects your property and possessions in the event of damage or theft.

- Health insurance

- Portfolio management tools

These are tools and services that can help people manage their investments and financial planning goals. Some popular options include robo-advisors, which use algorithms to create and manage a diversified investment portfolio.

By understanding the different financial products available, individuals can make informed decisions that align with their financial planning goals.

Key highlights from our report on financial products owned by Brits

According to our survey, here are some key highlights of financial products owned by Brits:

- Over half of Brits (58%) have a savings account.

- One in four Britons (24%) own stocks.

- 17% of UK respondents hold managed funds.

- Over one in ten (13%) Brits invest in ETFs.

- One in four (24%) Brits report holding cryptocurrencies.

- Over one in four (26%) Brits have a private pension.

- One in five (20%) Brits hold some kind of insurance product.

💡Want to know what financial product UK consumers are planning to own next?

Go to our Analyser and find out!

How Brits gather information on financial products: The rise of social media and alternative sources

The Appinio Hype Train Report shows that a considerable proportion of Brits (38%) seek advice from their friends and family members to gather information about financial products, while 35% rely on traditional banks, and 33% on financial advisors.

Surprisingly, over a quarter of Brits (27%) turn to social media platforms (excluding YouTube), for financial advice.

Among the younger generation, particularly Millennials, the number of people seeking financial advice from social media platforms is even higher, with 43% using this medium.

YouTube and podcasts are the preferred channels for 42% and 38% of Millennials, respectively.

These statistics indicate that the traditional channels used by financial institutions to educate and inform their customers need the support of new and innovative ways to educate and engage younger demographics.

Digital Banking in the UK

Digital banking has become an increasingly popular option in the UK, especially among younger generations. Digital banking are banking services that are available online or through mobile apps, allowing customers to manage their finances on-the-go.Digital banks in the UK offer a range of financial products and services, including investment accounts, savings accounts, and retirement planning products.

Well-known benefits of digital banking include:

- Convenience

- Flexibility

- 24/7 access to the accounts

- Easily monitor portfolio

- Make trades on the go, without having to visit a physical bank.

Additionally, digital banks often have lower fees and higher interest rates on savings accounts, making them an attractive option for budgeting and saving.

42% of Brits hold an account at a digital bank and 11% of Brits are planning to open one.

Some of the most common reasons why UK respondents have switched or are considering to switch to a digital bank were:

-

Attractive mobile / web app (52%)

-

Better accessibility (46%)

-

Easier to use when compared to traditional banks (42%)

-

Better financial products (35%)

- Easy international transfers (31%)

The most common reason for switching to a digital bank is the appeal of an attractive mobile or web app, followed closely by better accessibility. This suggests that consumers are drawn to digital banks because of the convenience and ease of use provided by their technology.

Additionally, a significant portion of respondents cited ease of use as a factor in their decision to switch to a digital bank. This could indicate that consumers find traditional banks to be more complicated and difficult to navigate, and that digital banks offer a simpler and more streamlined experience.

Interestingly, some consumers also cited better financial products as a reason for switching to a digital bank. This suggests that consumers are not only attracted to the technology provided by digital banks, but also to the financial services and products that these banks offer.

Finally, a smaller but still significant portion of respondents cited ease when doing international transfers as a factor in their decision to switch to a digital bank. This could indicate that digital banks are seen as a more convenient and cost-effective option for international transactions compared to traditional banks.

There are many digital banks in the UK, each with its own unique features and benefits. Some popular digital banks in the UK include Monzo, Starling Bank, and Revolut.

Although digital-only bank account owners may attest to the product's value, the level of trust from the general public towards these banks is still lower than that for traditional banks.

89% of those who do not have a digital-only bank account find traditional banks trustworthy to some extent, while only 67% say the same for digital-only banks. But there is a way to win the hearts and loyalty of these detractors.

When asked what offers or features would make they switch, digital bank detractors listed the following ones:

- Cashback 41%

- Lower / no fees 37%

- Instant money transfers 28%

Overall, these statistics suggest that people are looking for tangible benefits when it comes to digital banking, such as cashback, lower fees, and instant money transfers.

Britons' saving habits and goals

Savings are an essential component of personal finance, providing financial stability and a safety net for unexpected expenses.

As we’ve read before in this article, a savings account is a common financial product, 58% of Brits hold one.

It can be opened at banks or other financial institutions. It allows individuals to save their money and earn interest on the balance. Savings accounts are a low-risk investment option, making them ideal for people who want to protect their money while earning interest.

The Appinio Hype Train Report reveals that one in five Brits (21%) has less than £1,000 in savings and that two thirds (66%) manage to put aside less than £500 each month.

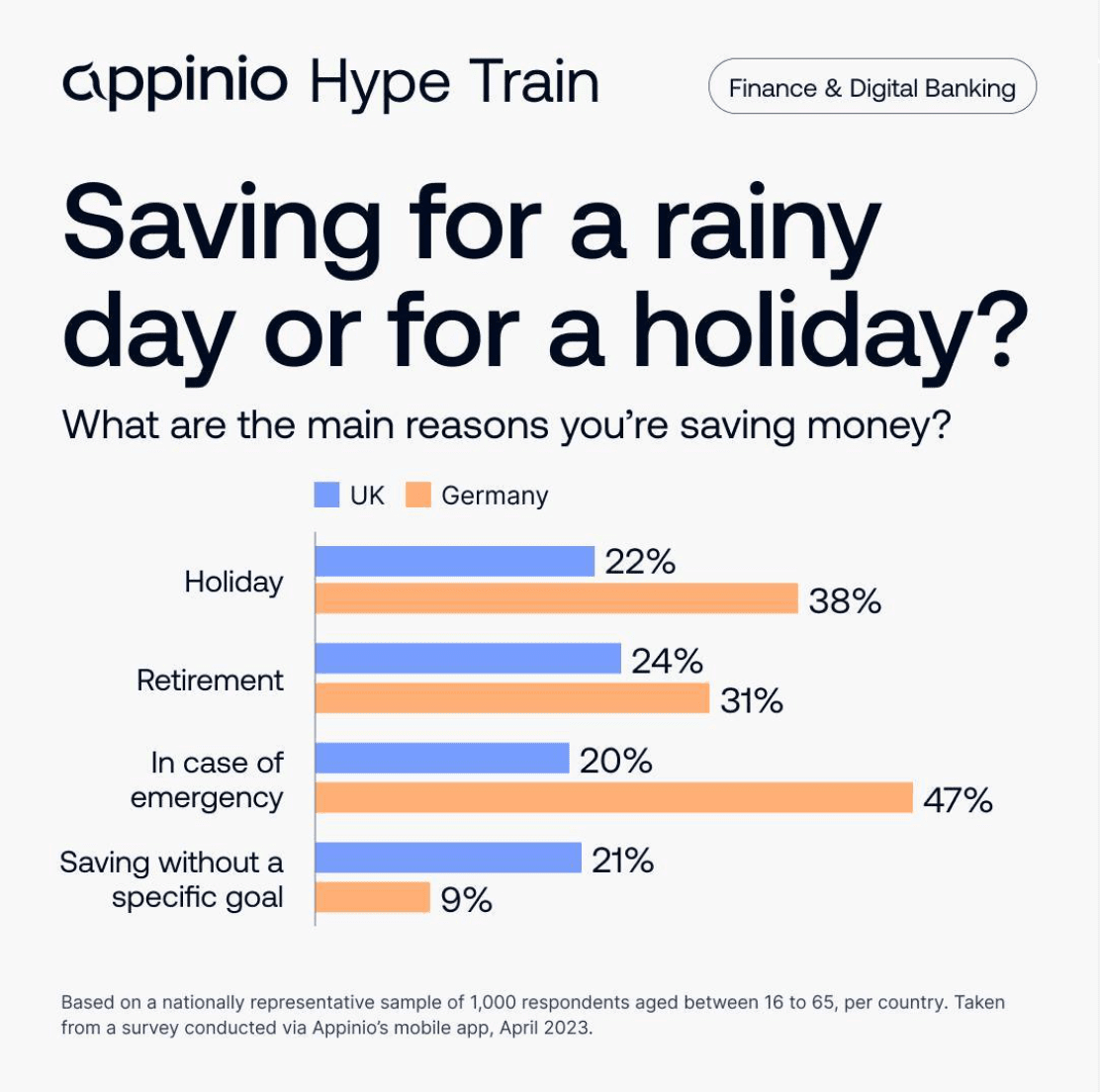

But what are the things Britons are saving for?

Let’s have a look at their saving goals.

Top saving goals among people in the UK

- Retirement

One quarter (24%) of Brits are currently for retirement.

Men are more likely than women to save for retirement, 30% vs. 18%.

This could be a positive sign, as it suggests that people are thinking ahead and taking steps to ensure their financial security in their golden years.

However, saving for retirement, especially at a young age, could also be seen as a negative sign. Brits may not be confident in the ability of the government and welfare measures to meet their needs when they will exit the workforce. - Holiday

22% are saving for a holiday.

People are prioritising experiences and making time for leisure in their lives.

Millennials are the most likely to be saving for this purpose (29%), this is in line with the profile of Millennials, always prioritising experiences over tangible products. - No goals, just savings

21% are saving without a specific goal in mind.

This could indicate that they have a general desire to build up their savings or create a financial safety net.

Gen Z and Boomers are the most likely to be doing so, both at 30%. - Emergencies

21% are saving for the unexpected.

A sensible approach to financial planning. It's always a good idea to have some savings set aside for unexpected expenses or job loss. 45-65 years-olds are the most likely to be saving in case of emergencies at 25%. - House

16% are saving to buy a house.

Property ownership remains an important part of the British dream for many Brits. This is a significant financial goal that requires a lot of planning and saving.

Gen Z are the most likely to be saving for this purpose (29%), followed closely by Millennials at 28%.

However, reaching some of these goals seems like a daunting task for Brits.

When it comes to saving for retirement, over one third (38%) of Brits don’t feel confident in their ability to save enough.

One third (30%) is not confident in saving enough money to start their own business and 28% doesn’t think they will be able to buy rental property with their savings.

While 26% don’t feel confident they’ll be able to save enough to afford to pay a house or pay mortgage for a house.

Conclusions on Britons finances

Finance and personal finance are topics that affect everyone and are becoming increasingly important in our modern world.

The shift towards digital banking and the availability of various investment options have made it easier for people to manage their finances and grow their wealth.

However, it is essential to understand the various financial products available, their benefits, and their risks and invest in increasing the levels of financial literacy.

This article and the latest Appinio Hype Train Report have explored some of the most common types of investments, the reasons why people switch to digital banks, and what Brits are saving for and hopefully, provided food for thought for the development of the next generation of financial products and services.

Want to run your own study?

Then take your market research efforts to the next level, sign up to Appinio for free and talk to us.

Get facts and figures 🧠

Want to see more data insights? Our reports are just the right thing for you!