Pricing Analysis: The Gabor-Granger-Method

Appinio Research · 20.10.2022 · 7min read

Content

Introduction

Determining the price of a product or service is an essential step for every company. A critical success factor here is to know the opinion of your customers in advance. Which price increase is justifiable without a disproportionate drop in customer demand? Where is the threshold at which most customers are no longer willing to pay the price?

In addition to the Van Westendorp method, the Gabor-Granger method offers a way to determine the optimal price of a product or service by using a price-demand function.

What is the Gabor-Granger-Method?

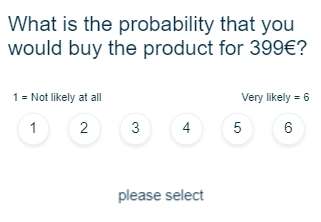

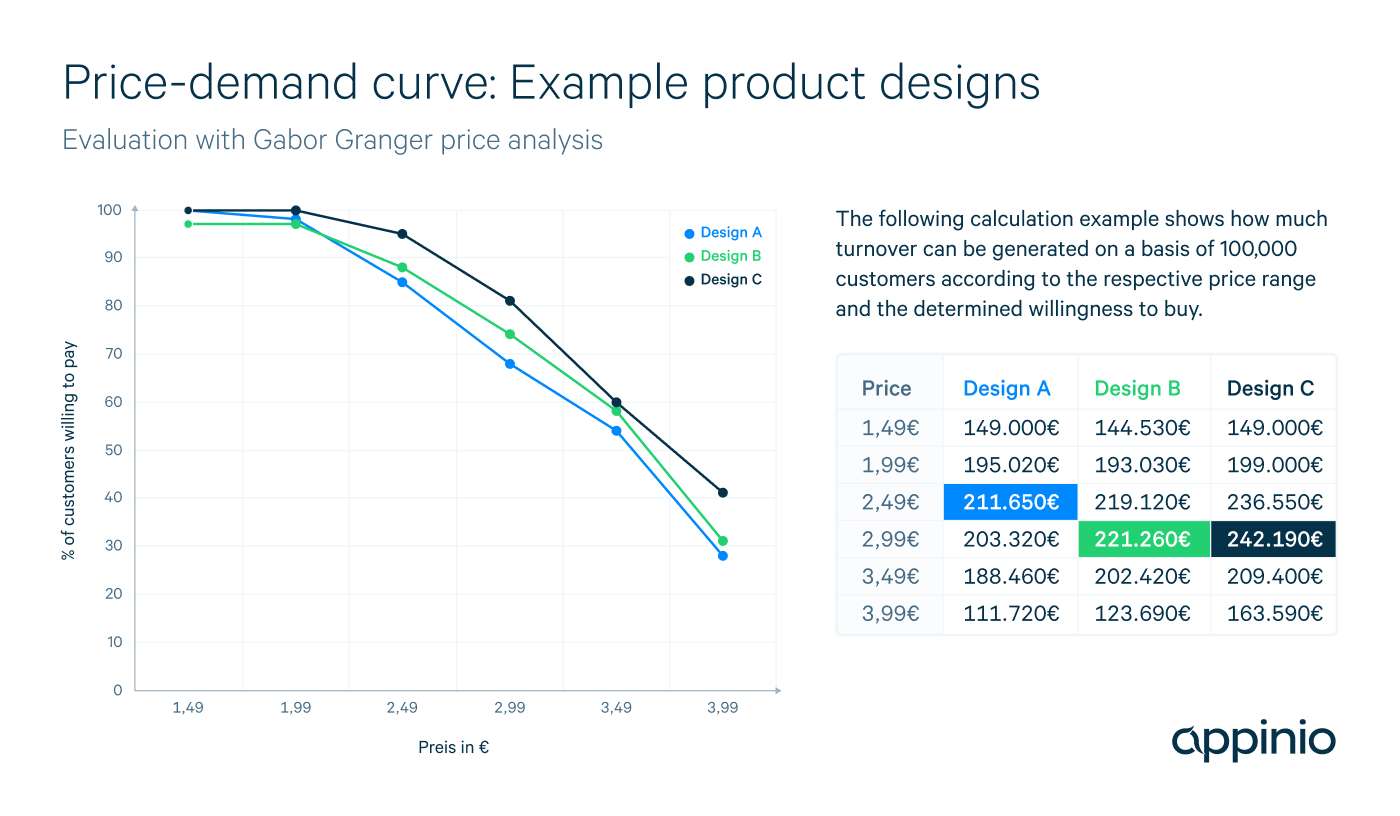

The Gabor-Granger method measures consumers' willingness to buy a particular product or service for a series of previously defined price points. A price-sales function is estimated using the stated probabilities of all participants. Then based on a sales scenario, the optimal price can be determined.

Typically, the Gabor-Granger Method addresses the following questions:

Is it possible to increase the price without a drastic decline in sales?

Which are the price points where the consumers' willingness to pay increases or decreases disproportionately?

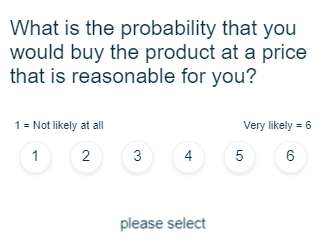

Survey Technique

For example:

It is possible to determine how many consumers are willing to buy the product or service at the corresponding price for each price point. In this way, a price-demand function and the potential turnover per price point can are estimated. In the ideal case, it is quite clear to see at what point the hypothetical product's sales will decrease. The reason for that is that the price is perceived as unfair by a large share of participants. As a rule of thumb, this threshold is a "kink" in the graph of the price-demand function.

Pros & Cons

The Gabor-Granger method leads to a relatively low survey effort and is easy to perform. It provides crucial information on a consumer's willingness to pay and the perceived value of a product. Accordingly, it has become a frequently used and highly valued tool for price analysis.

We have validated the Gabor-Granger method over various customer projects using actual market prices and created revenue.

Despite its advantages, one disadvantage of the Gabor-Granger method is that competing products are ignored in the survey.

Thus, if respondents say that they would buy a product at a certain price, the competition may be offering a similar product at a comparable price. Therefore, the test values may not be 100% valid in the context of the market.

To reduce such an effect, we always recommend that you first show an exemplary shelf with competitive products and their prices as part of the price analysis. Test cases with customers have indicated that Gabor Granger results come closer to the actual price-demand figures with previously shown competitor prices.

The Gabor Granger method particularly suitable under the following conditions:

- The company already has fixed price expectations for the product/service

- It is a newly introduced or rarely purchased product for which it can be assumed that the target group does not have a precise idea of the product's design and features.

Comparing the Gabor-Granger-Method & the Van Westendorp-Analysis

Both the Van Westendorp price analysis and the Gabor-Granger method examine consumers' willingness to buy and price sensitivity.

In contrast to the Van Westendorp analysis, however, the Gabor-Granger method does not ask consumers about their willingness to pay prices on an unsupported basis, but on a supported basis. This means that participants in a study are shown predefined prices and indicate their purchase probability as a percentage. The Van Westendorp method, on the other hand, asks four different open-ended questions that are used to narrow down the price range of a respondent.

The Van Westendorp price analysis is particularly suitable under the following conditions:

- the presented products are rather inexpensive, low involvement products (e.g. FMCG products)

- they are known at least in terms of their character and among which the respondents have a concrete idea

- the products appeal to a broad target group, i.e. they are not niche products

Conclusion for Gabor-Granger

The Gabor-Granger method should always be deployed when the target group does not have a clear idea of the appropriate price. This is the case, for example, when a product is newly introduced to the market or is generally sold less frequently (e.g. innovations, niche products, etc.). If this is not the case, and the product is well-known and appeals to a broad target group, the Van Westendorp method may be more suitable.

Curious to try it out yourself?

Get facts and figures 🧠

Want to see more data insights? Our reports are just the right thing for you!